Editor’s Note: This article is from WeChat WeChat official account on Entrepreneurship, written by Xiaoxue, and reproduced by Chuangyebang with authorization.

A bowl of rice noodles with only 5 yuan and 7 yuan has not only eaten hundreds of billions of markets, but also been favored by capital for many times. So, how do entrepreneurs find opportunities in small rice noodles?

Today, we will dismantle the rice noodle industry.

With a history of 3,000 years, it has strong regional characteristics.

Rice noodles are made of rice as the main raw material through various processes, and then boiled or dry-fried with various vegetables or soup materials. The history of rice noodles can be traced back to the Zhou Dynasty more than 3,000 years ago. At first, rice and wheat were used as raw materials to make paste-like rice noodles. Linear rice noodles appeared in the Southern and Northern Dynasties, and the rice noodle technology gradually matured in the Sui and Tang Dynasties. But rice is scarce, and early rice noodles were aristocratic food. Later, with the increase of rice planting scope and yield, the production technology of rice flour became more and more mature, and rice flour only entered the homes of ordinary people after the late Qing Dynasty.

Nowadays, where rice is cultivated, there are almost rice noodles, which determines the strong regional characteristics of rice noodles and invisibly becomes an important factor restricting the development of rice noodles. Rice noodles were popular in the south at first, and then gradually spread to the north. The branches of rice noodles are complex and extensive, which can be roughly divided into rice noodles, rice noodles, river noodles, kway teow and other categories. The variety forms are similar, but the taste is slightly different. For example, although the main ingredients of rice noodles and rice noodles are rice, sweet potato powder and potato powder are added to the rice noodles, so the taste will be different.

▲ Source: Network | Deep research and finishing

According to the "2019 Chinese Fast Food Industry Catering Big Data Research Report", in 2019, the number of stores in the powder category has reached 229,000, accounting for 8.9% of Chinese fast food restaurants, second only to rice fast food and noodles. With the popularity of specialty rice noodles such as snail powder, marinated powder and pork intestines powder, rice noodle brands on the market are also increasing. Enterprise survey data shows that from 2017 to the first half of 2021, there were nearly 80,000 newly registered rice noodle enterprises in less than five years. According to the data of China Commercial Industry Research Institute, the market size of China’s rice flour industry will exceed 100 billion yuan in 2020.

According to public comment data, Shenzhen, Guangzhou and Nanning have the largest number of rice noodle-related restaurants in China, followed by Chongqing, Shanghai, Beijing and Changsha. Moreover, since the beginning of the epidemic, the consumption demand of rice noodles has increased. In particular, Li Ziqi once again brought snail powder to the fire, and also launched a joint venture with the People’s Daily to push snail powder to the hot search again.

The main material in the upper reaches of rice noodles is rice, so the rice noodle production area is extremely wide, and most places where rice can be planted have built rice noodle production bases.Especially in southern provinces (regions) such as Jiangxi, Guangdong, Guangxi, Zhejiang, Fujian, Hunan, etc., this has caused the situation that the upper reaches of rice noodles are extremely scattered. For example, Ganshui Town, Qijiang, Chongqing planted 200 mu of rice flour special rice in order mode; Yuechi County, Sichuan Province has also set up a planting base for rice flour in Yutai Mountain.

Followed by raw materials such as sweet potatoes, potatoes and other rice flour additives; There are also raw materials around rice noodles, such as beans, snails, sour bamboo shoots, peas, meat, sauces, sauerkraut, peppers, fungus, peanuts, yuba, daylily, cowpea and so on. Take snail powder as an example, its raw materials are basically produced in Liuzhou. Liuzhou has a special comprehensive breeding area for rice snails, as well as a special demonstration base for the cultivation of auxiliary materials such as beans, peppers, bamboo shoots and auricularia auricula. All counties and districts will make every effort to develop large-scale snail breeding and build contiguous breeding bases. The planting area of bamboo shoots is over 100,000 mu. The data shows that the scale of Liuzhou snail powder raw material base has reached more than 500,000 mu. The output value of bagged snail powder in Liuzhou has reached 3 billion yuan, of which the income from agricultural raw materials accounts for 20~30%.

The middle reaches are mainly processing plants, distributors and foundries of various colors, and are also in a highly decentralized state.In the early days, the rice noodle production industry was mainly in the form of small family workshops. In the 1950s and 1960s, extensive rice noodle factories began to appear, and the production equipment used was still in the traditional mode. After the reform and opening up, especially in the past two decades, some formal modern rice noodle factories came into being.

For example, Liuzhou has built a snail powder industrial park, attracting more than 100 enterprises such as raw material supply, product processing, e-commerce, logistics and distribution. Changde rice flour established an industrial development group; Yuechi County, Sichuan Province is also promoting an industrial park integrating production, research and marketing to attract rice flour processing enterprises to settle in the park.

Many factories have also formed their own R&D characteristics. For example, Sanyang Gum Wheat in Guilin is a high-tech innovative enterprise integrating product research and development, production, sales and service. At present, it has reached the largest daily output in the country in the manufacture of moisturizing fresh powder, with a daily output of 250,000 bags. Moreover, it adopts UHT ultra-high temperature instantaneous sterilization and composite biological preservation technology, which can keep rice noodles fresh for 12 months at room temperature without stopping. You know, the shelf life of most wet powders is about one month.

▲ Source: Sanyang Rubber Wheat Factory

Some big chain brands have relatively stable supply channels. For example, Wumingyuan rice noodles originated in the northeast have set up branches and built warehousing and logistics centers in eight cities, including Shenyang, Beijing, Shandong, Shanxi, Shaanxi, Hebei, Wuhan and Henan. Guifenghuang rice noodles and Liziqi snail powder mainly rely on foundries.

Nowadays, many factories will sell goods directly through e-commerce channels. For example, Liuzhou snail powder industry is very complete in the development of e-commerce. Some enterprises in the snail powder e-commerce industrial park will bring goods live in the workshop. And Taobao search "wholesale rice noodles", you can also see a large number of manufacturers, distributors and so on.

Downstream "big category, small brand" is highly dispersed, and there is no national chain brand at present.Although some well-known rice noodle brands have been born in recent years, for example, there are more than 500 chain stores of potato noodle for brothers and sisters, the total number of stores of Wumingyuan rice noodle has exceeded 2,200 at present, and the total number of stores of Grains and Fish Powder has exceeded 4,700, and there are about 60 direct stores in Baman. However, due to the obvious regional characteristics of rice noodles, there are not many brands nationwide. Our investigation found that at present, couples’ shops and regional brands are the main ones, and they are mainly concentrated in the southern cities in the third and fourth lines. The rent is low and the goods are available nearby. Moreover, for southerners, eating rice noodles is just needed.

Regional differences make it difficult to form a national chain brand.

Because there are many and complicated categories of rice noodles in China, different cities have different tastes and processing techniques of rice noodles, and different regions also have different ways to eat rice noodles. Therefore, many rice noodle brands are only deeply cultivated in the region, or they can only focus on the special taste of a certain place, so it is difficult to make it big and complete. For example, Baman is concentrated in Beijing, Tianjin and Hebei, most of Dafulan’s stores are in Shenzhen, Sanliang Powder focuses on Dongguan, Xiaoman Handmade Powder is mainly in Shanghai, etc. All brands are well-known locally. However, a few brands that have expanded their stores to the whole country, such as grain fishing powder, have not formed an influence corresponding to the volume in the national catering market.

Moreover, rice noodles are very fresh, but the shelf life of fresh rice noodles is mostly only one month or even shorter, which makes it difficult for rice noodles to expand nationwide.

Site selection determines the success rate of opening a store by 50%. According to our research, at present, rice noodles are still mainly eaten in the hall, and even take-away distribution is relatively small. For one thing, because rice noodles have no higher added value, the unit price is difficult to go up. For another, rice noodles with soup are not easy to transport, which will affect the taste. Real rice noodle lovers will be very picky about the taste and easily affect the repurchase rate. Moreover, the take-away platform is very high, and the profit of the rice noodle shop will be spread very thin.

Tanzai International is extremely cautious about site selection. Any proposal to open a new restaurant must be approved by the board of directors and the site selection committee, which is composed of the chief executive officer, the chief financial officer, the business development director and the general manager. Only after carefully evaluating the feasibility of the proposal can the proposal be approved. The evaluation criteria include whether the population and consumption demand in the potential area are sufficient to support the new restaurant, and the potential encroachment on other restaurants in the neighborhood.

▲ Source: Photo Network

During the epidemic, restaurants in shopping centers suffered heavy losses, and community stores will become a new direction. Xu Ming ‘en, director of investment promotion of Dagu rice noodle, once said: "Before the epidemic, Dagu rice noodle was a shopping mall, and later it may be considered to focus on opening a street shop." Most of Sister Lu’s stores are located in complexes, communities, street shops, transportation hubs, shopping centers and other places where there are more passengers, and then share the cost by expanding the stores.

The production technology is not complicated and the threshold is low.Rice noodles are easy to operate, quick to produce, independent of chefs, and easy to achieve standardization. With the emergence of prepackaged ingredients, rice noodles basically achieve the effect of instant meal. Moreover, the supply channels are diverse and the cost is low. For example, we casually compared two rice noodle factories and one supplier on Taobao. The price of dry powder is about 4 yuan/kg, and the price of wet powder is about 6 yuan/kg. Almost three bowls can be produced per kg. Even if it costs only six or seven yuan, the gross profit can reach about 60%.

Consumer awareness is high, and the epidemic has given birth to greater demand.As just needed, there are statistics,More than 40% consumers in China have taken rice noodles as their main meal.Coupled with the epidemic, the blessing of e-commerce platforms, short videos and social platforms has strengthened consumer awareness. According to our investigation, it is found that rice noodle shops are more suitable to open in the south, preferably in cities with rice noodle producers. Users in the south do not need user education, and they can use local materials, and the costs of rent and manpower in third-and fourth-tier cities are lower, which is a good direction for entering the market.

Policy support and promotion.In April, 2021, General Secretary visited Liuzhou snail powder production cluster, and proposed: "The development of industry must have its own characteristics. Snail powder is a feature, which has caught everyone’s stomach and made it an industry on the tip of the tongue. " In June, snail powder was listed on the national intangible cultural heritage list. The "14 th Five-Year Plan" has mentioned "characteristic industries" many times. As a characteristic industry with regional characteristics, rice flour will also receive greater policy support in the future.

Addictive taste, low price and high repurchase rate.Some people joked that "there are only 0 times and countless times to talk about powder", which shows the addictive characteristics of people eating powder. In addition to the refreshing feeling and low price, "spicy" is also a major feature, and spicy can stimulate endorphins to bring pleasure. According to the data of Meituan in 2020, the proportion of "spicy" after 90, 95 and 00 all exceeded 50%. In 2020, the top three restaurants will be hot pot, snack and Sichuan cuisine. Both hot pot and Sichuan cuisine have heavy taste attributes, and the refreshing feeling brought by spicy food is addictive. Zhang Tianyi, the founder of Baman Rice Noodle, once said that the reason why users like to eat Hunan Rice Noodle is "spicy enough and mellow enough".

Market recognition, capital entry.In the past two years, capital has entered the rice noodle/rice noodle brand one after another. For example, Hong Kong Fat Juice Milan obtained two financing, and Guizhou "Guifenghuang" completed the A round of financing; Hunan Baman Rice Noodle has successively obtained B+ and C rounds of financing; Guilin rice noodle suofenlao received 10 million RMB angel round financing. Even more, Tanzai International, the first stock of rice noodles, landed on the Hong Kong Stock Exchange, showing that capital began to pay attention to the track of low-priced snacks.

1. Standardization and process are the guarantee of becoming bigger and stronger.

Throughout the current well-made rice noodle brands, there are very efficient standardization processes.For example, Baman rice noodles are worth learning from in terms of standard and quantitative thinking. Its core business secret is a spice bag composed of 24 kinds of seasonings, which can ensure that every bowl of beef powder is made with the same high-quality taste. After the business expanded, they split the spice package to different suppliers, and each supplier only produced several seasonings with a specific ratio to keep the ingredients secret. At the same time, other raw materials also have standardized and quantified processes, such as stewing the bones with tendons for not less than 5 hours, using only early-season indica rice with amylose content of not less than 25% for rice flour, and not less than 399 for beef powder (SHU, Scoville Heat Unit).

Sister Lu also achieved rapid expansion by standardization. The product research and development center will provide the product quality, specifications and price requirements to the supply chain center, which will further determine the suppliers. Follow up the whole supply chain and deliver it to the store every day to ensure the fresh taste of food. There are uniform standards for rice noodles, sauces and standard ingredients. Pot-stewed snacks are uniformly distributed by factories and can be produced by heating in stores, which improves operational efficiency.

If you want to go far, you must take the healthy rice noodle route. During the interview, it was found that at present, more than 60% of rice noodles in China are easy to break because of the low quality of technology and rice, so many manufacturers add a lot of starch, which leads to high sugar content in rice noodles and greatly reduces their health. Some poor quality flour will turn pale blue after cooking, while the really good rice flour and soup are pure white. For example, in Sanyang Gum Wheat in Guilin mentioned above, professional doctors will join the R&D team to develop rice flour from the perspective of nutrition. The rice flour developed by their unique technology can reach 100% rice content. At present, this enterprise is a supplier of many big brands such as Baman and Uni-President.

▲ Source: Sanyang Rubber Wheat Factory

▲ Source: Sanyang Rubber Wheat Factory

In addition, statistics show that the average life cycle of domestic rice noodle shops is more than 200 days, so it is very important to innovate products and make their tastes unique. For example, Baman’s products iterate 30% every year, but "SKU only keeps 10", so don’t worry about suffering from great inventory pressure. In the choice of ingredients, it is also necessary to form its own characteristics. For example, the sausage raw material of Da Fran only chooses Ningxiang pork, and Ba Man cooperates with Fanye Chili sauce; Four young rice noodles are selected from Hunan.

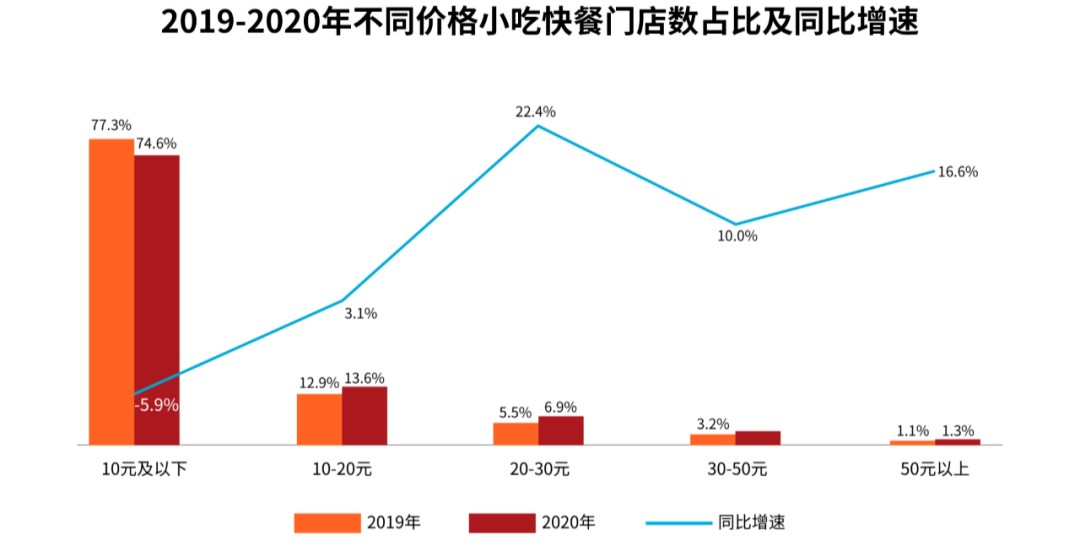

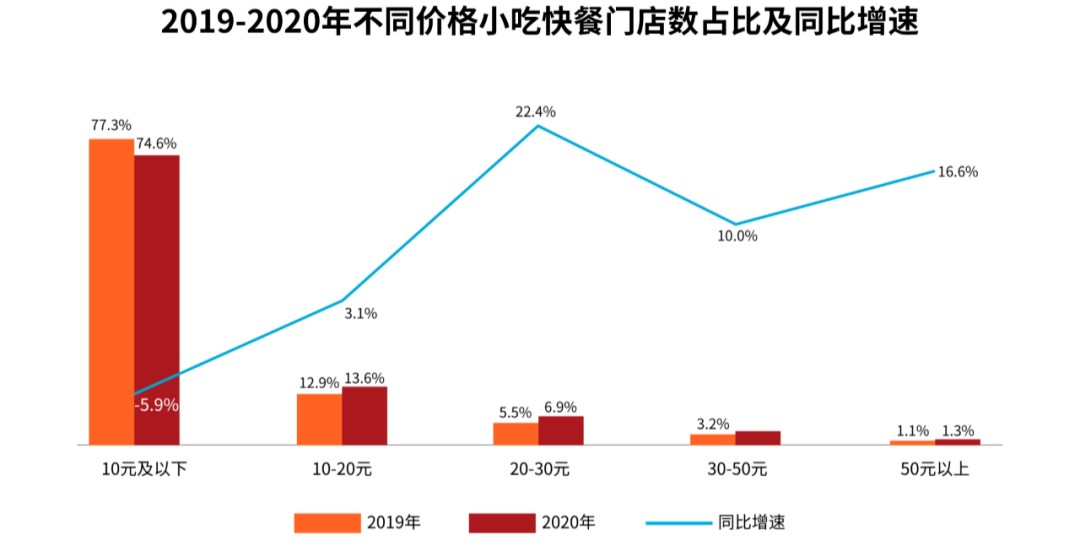

It can also be expanded in terms of categories, giving consumers diversified choices and raising the unit price of customers. According to "China Catering Big Data 2021" released by the catering boss’s internal reference, the number of stores below 30 yuan per capita decreased by 5.3%. In the snack category, the customer unit price rose from 22.8 to 25, an increase of 9.5%, and more and more snacks were upgraded and redone. The data of Meituan also shows that in 2020, snack and fast food stores in 10 yuan and below will be the mainstream; However, the growth trend of high customer unit price stores is obvious, with the fastest growth in the range of 20~30 yuan, which shows that there is still much room for improvement in the customer unit price of snack categories such as rice noodles.

▲ Source: Meituan | Deep research and finishing

At present, many brands adopt a mixed business model of overlapping snacks. For example, Da Fran’s "rice flour+snacks", Xiaoman’s handmade flour "rice flour+snacks+sugar water", Gui Fenghuang’s "mutton powder+snacks+Guizhou hot pot" and Sister Lu’s "marinated powder+snacks" and so on. This model can also adapt to various consumption scenarios such as brunch, dinner and snacks, and extend the business hours. For example, Sister Lu has realized the operation of "10 am to 10 pm" for a long time, even without closing for 24 hours, and the floor efficiency has been greatly improved.

The new national tide and the rise of generation Z have enabled rice noodle shops to "redo" from the inside out. At the level of store design, the cool black of Ba Man and the warm orange of Da Fran all pay more attention to consumers’ experience and pay attention to youthfulness. Qiao Fenghuang has formed a unique brand recognition with the brand concept of "aesthetics+Miao culture"; Guangzhou’s "in the alley" snail powder shop, because of its outstanding value, once became a holy place for punching cards through the decoration of literary petty bourgeoisie. By raising the brand tonality, the stereotype of rice noodle "street shop" has been subverted, and the customer unit price is correspondingly higher.

In the future, the rice flour industry will adopt the unbounded operation mode of "from store to home", "catering+retail" and "online+offline", and the chain and scale will have more advantages in this respect. Last year, double 11 Liziqi sold 7 million bags of snail powder online, which made many people see the magic of e-commerce. The impact of the epidemic on offline stores has also promoted many rice noodle brands to fight online. Yang Aijun, co-founder president of Yunnan Catering and Food Industry Association, said, "After the epidemic, the retailing of rice noodle products is bound to be a trend." The best example is that the production and sales of bagged snail powder will exceed 10 billion yuan in 2020.

Relying on the community to gain the hegemony of the first batch of users, during the epidemic, it also made up for the offline losses through e-commerce business. The data shows that in 2020, nave’s food revenue will only account for 20%, and the other 80% will come from take-away, e-commerce and offline retail. As of April 2021, e-commerce business grew by 400% year-on-year. In addition, rice noodle brands such as Guifenghuang, Dafulan, Siyou Youth and rice rolls in Hongli Village are all accelerating the layout of new retail channels for e-commerce.

As early as 2016, Baman introduced fresh food and prepackaged foods. It is distributed by the cold chain to the freezers of Shangchao convenience stores all over Beijing for sale-which expands the time and space boundary of products to days and dozens of kilometers.

The shelf life of prepackaged foods is as long as 120 days. The food factory produces dehydrated dried rice flour, sealed original soup, large pieces of beef, supporting side dishes and other raw materials, which are packaged after high-temperature sterilization and sold to retailers all over the country-the time and space boundary of products is further expanded to 2008 and the whole country. Today, Baman has formed an omni-channel layout of online e-commerce, offline supermarkets and convenience stores. Xu Ming ‘en, director of investment promotion of Dagu Rice Noodles, said that Dagu Rice Noodles will develop instant packaging rice noodles to better meet the new eating habits of ordinary people.

Of course, the cost of e-commerce is higher. We learned from the interview that the e-commerce platform will extract 23% of the sales, and it has higher requirements for operational capabilities and R&D capabilities, which is more suitable for the chained multi-store model.

Conclusion:The decentralized status quo of offline rice noodle shops in China and its low threshold allow entrepreneurs to find opportunities.

References:

How is this online celebrity rice noodle shop, which was selected into the Harvard Case Library? | Exclusive Case China Europe International Business School

The national rice noodle market is divided, where is the next spring of this category? | Observation of catering brands

How do local brands break through in the 100 billion rice noodle market? | Hongcan. com

(The article is only based on industry dismantling and does not constitute any investment advice.)

This article (including pictures) is reproduced by the cooperative media and does not represent the position of the entrepreneurial state. Please contact the original author for reprinting. If you have any questions, please contact editor@cyzone.cn.

▲ Source: Sanyang Rubber Wheat Factory

▲ Source: Sanyang Rubber Wheat Factory